Senior Tax Accountant

BMG Outsourcing Inc.

職位描述

福利待遇

津貼

電信津貼, 交通補貼

員工表彰與獎勵

員工表彰計畫, 節日禮物

法定福利

13薪, Pag-Ibig 基金, 帶薪假, 菲爾健康, SSS/GSIS

健康保險

牙科保險, 健康維護組織

額外福利

公司設備, 免費餐

休假和請假

喪假, 產假和陪產假, 育兒假, 病假, 單親假, 女性特殊假, 休假

Grow your career with BMG Outsourcing – a leading, well-respected Australian-owned outsourcing company with offices in Clark and Sydney, offering long-term rewarding careers with our clients.

We are seeking a highly capable and detail-oriented Senior Tax Accountant to manage complex tax compliance and advisory work for Australian clients. The successful candidate will have strong technical knowledge of Australian taxation law, including Division 7A, Capital Gains Tax (CGT), and Fringe Benefits Tax (FBT), and will be responsible for preparing financial statements, tax returns, and workpapers from start to finish. You will work closely with clients and internal teams to ensure compliance, accuracy, and value-added service.

Job Responsibilities

Tax Compliance and Financial Reporting

- Manage end-to-end tax and compliance work for Australian entities including individuals, partnerships, companies, and trusts

- Prepare and review financial statements in accordance with Australian Accounting Standards

- Draft and lodge income tax returns ensuring compliance with current ATO requirements

Data Analysis and Software Integration

- Analyse and interpret financial information received from clients in a wide range of formats

- Enter and map data accurately into the client’s preferred accounting or tax software (e.g., Xero, MYOB, QuickBooks, HandiTax, APS)

ATO Portal Usage

- Access and retrieve client information from the ATO Portal including lodgement records, income tax accounts, integrated client accounts, PAYG instalments, and notices of assessment

- Use ATO data for reconciliation, lodgement tracking, and review of client obligations

Workpaper Preparation and Documentation

- Prepare comprehensive workpapers and supporting schedules based on client source data and software exports

- Ensure all workpapers meet internal documentation and audit standards

Accounting Adjustments and Reconciliations

- Process year-end adjusting journal entries

- Reconcile client records and update their accounting system to reflect finalized year-end balances and tax positions

Requirements

- 5+ years of experience in Australian taxation and compliance

- 5+ years of experience in Australian accounting

- Certified Public Accountant

- Experience in working with Australian SMEs

- Experience in the preparation and review of financial statements and income tax returns for individuals, sole traders, companies, and trusts

- Competent with computer operations as well as specific applications such as Xero, MYOB, QBO

- Excellent oral and written English communication skills

- Keen to learn and develop computer competencies

- Able to work independently through tasks until completion

- Excellent personal time and task management skills

- Ability to multi-task and meet deadlines

- Strong communication skills, excellent work ethic, and ability to work as part of a team

- Friendly, committed, and flexible attitude

- Positive mindset and strong willingness to learn

Dela Cruz Diana Rose

People and Culture AdminBMG Outsourcing Inc.

回應率高

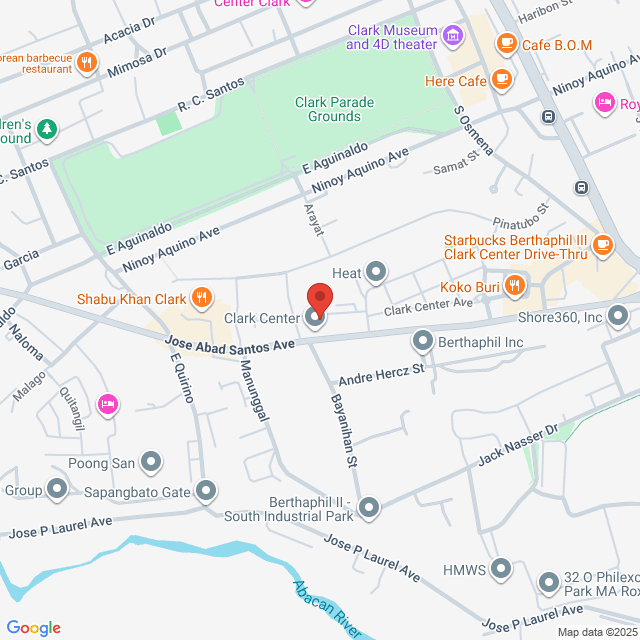

工作地址

Unit B 2nd Floor, 2/F Clark Center 9, Berthaphil, Pinatubo Ext. Jose Abad Santos Ave Zone, Clark Freeport, Angeles, 2023 Pampanga, Philippines

發布於 01 October 2025

猜你想看

查看更多Senior Tax & Business Services Accountant

Cloudstaff

CloudstaffNT$52.3-68K[月薪]

现场办公 - 安吉利斯5 - 10 年經驗本科全職

Maximo JorgeHR Officer

Tax Accountant

Digital Planners Corporation

Digital Planners CorporationNT$20.9-36.6K[月薪]

现场办公 - 安吉利斯3 - 5 年經驗本科全職

Corporation Digital PlannersHR Officer

Tax Compliance Officer

Juan D. Nepomuceno Sons, Inc.

Juan D. Nepomuceno Sons, Inc.NT$10.5-13.1K[月薪]

现场办公 - 邦板牙1-3 年經驗本科全職

Cunan DarrelHR Recruitment Specialist

Senior Accountant

BMG Outsourcing Inc.

BMG Outsourcing Inc.NT$52.3-57.6K[月薪]

现场办公 - 安吉利斯3 - 5 年經驗本科全職

Dela Cruz Diana RosePeople and Culture Admin

Accounting Staff急招

Ben's Windoors Inc.

Ben's Windoors Inc.NT$7.9-13.1K[月薪]

现场办公 - 安吉利斯<1 年經驗專科全職

FEGUIS JJHR Officer